Planning a cruise vacation is exciting, but unforeseen circumstances can quickly dampen the fun. Understanding what your travel insurance covers is crucial for peace of mind. This guide explores the intricacies of cruise travel insurance, clarifying what’s protected and what’s not, empowering you to make informed decisions before setting sail.

From medical emergencies to trip cancellations and lost luggage, we’ll dissect the various levels of coverage offered by different insurance plans. We’ll also delve into the often-overlooked exclusions and limitations, ensuring you’re fully prepared for any eventuality. By the end, you’ll be equipped to choose the right insurance policy for your specific needs and budget, allowing you to relax and enjoy your cruise to the fullest.

What is Travel Insurance?

Travel insurance is a safety net for unforeseen circumstances that can arise during your trip. It protects you financially from potential losses and disruptions, offering peace of mind so you can focus on enjoying your vacation rather than worrying about unexpected costs. Essentially, it’s a contract between you and an insurance provider that Artikels the coverage provided in exchange for a premium.Travel insurance policies typically cover a range of situations, from medical emergencies and trip cancellations to lost luggage and personal liability.

The specific coverage varies widely depending on the policy chosen and the circumstances of the claim. The goal is to mitigate the financial burden associated with travel mishaps.

Types of Travel Insurance Coverage

Different types of travel insurance cater to various needs and budgets. Understanding these differences is crucial in selecting the appropriate level of protection for your specific trip.

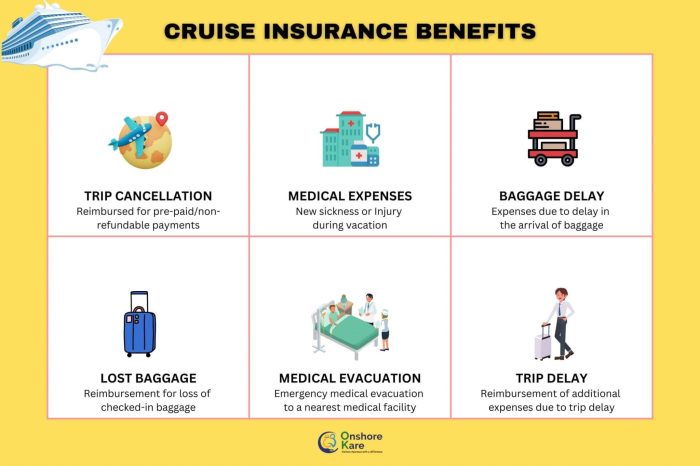

- Trip Cancellation/Interruption Insurance: This covers the costs of canceling or interrupting your trip due to unforeseen circumstances such as severe weather, medical emergencies (yours or a family member’s), or natural disasters. For example, if a hurricane forces the cancellation of your cruise, this coverage could reimburse you for non-refundable prepaid expenses.

- Medical Expenses Coverage: This is crucial for international travel, as medical costs abroad can be exorbitant. This coverage helps pay for emergency medical treatment, hospital stays, and medical evacuation if necessary. Imagine needing emergency surgery while on a cruise – this coverage could significantly reduce the financial stress.

- Baggage and Personal Belongings Insurance: This covers the loss, theft, or damage to your luggage and personal belongings. If your suitcase is lost or stolen during your cruise, this insurance can help replace your belongings.

- Emergency Assistance Services: Many policies include 24/7 access to emergency assistance services, providing help with things like finding medical care, replacing lost documents, and contacting family members.

- Other Potential Coverages: Some policies offer additional coverage for things like flight delays, missed connections, rental car damage, and even trip interruptions due to unforeseen circumstances affecting your travel companions.

Comprehensive vs. Basic Travel Insurance Plans

The choice between comprehensive and basic travel insurance plans hinges on your risk tolerance and the potential financial impact of unforeseen events.A basic plan typically offers limited coverage, focusing primarily on essential aspects like trip cancellation and medical emergencies. The premium is usually lower, but the protection is less extensive.A comprehensive plan, on the other hand, offers broader coverage, encompassing a wider range of scenarios, including those mentioned above, and potentially adding coverage for things like lost luggage, personal liability, and emergency assistance services.

While the premium is higher, the peace of mind and financial protection are significantly greater. For example, a comprehensive plan might cover the cost of a replacement cruise if your original one is canceled due to a ship malfunction, whereas a basic plan might not. The best choice depends on the individual’s risk assessment and the value they place on comprehensive protection.

Cruise Vacation Specific Coverages

Cruise vacations, while offering exciting adventures, also present unique risks. Understanding what your travel insurance covers is crucial for peace of mind and financial protection should unforeseen circumstances arise. This section details specific risks associated with cruises and how insurance can mitigate these potential problems.

Specific Risks Associated with Cruise Vacations

Cruises, while generally safe, expose travelers to various risks different from land-based vacations. These include the potential for medical emergencies far from home, the complexities of international travel and jurisdiction, and the increased chance of lost or damaged luggage due to multiple transfers. Severe weather events, ship malfunctions, and even geopolitical instability in the cruise’s destination can all impact your trip.

Examples of Situations Where Cruise Travel Insurance is Beneficial

Imagine a scenario where a medical emergency occurs mid-cruise, requiring immediate and extensive medical care. Travel insurance can cover the substantial costs associated with this, potentially saving you from crippling debt. Similarly, if a hurricane forces your cruise line to cancel your voyage, travel insurance can reimburse you for prepaid expenses like flights and excursions. Or consider the frustration of lost luggage; insurance can help replace essential items and alleviate the stress of a ruined vacation.

Common Cruise-Related Incidents Covered by Insurance

Many travel insurance plans offer coverage for a range of cruise-related incidents. Medical emergencies at sea or in port are frequently covered, often including emergency medical evacuation. Trip cancellations due to unforeseen circumstances, such as severe weather or family emergencies, are also commonly included. Lost or delayed luggage, often a significant concern on cruises, is another area where insurance provides valuable protection.

Additionally, some policies cover disruptions caused by unforeseen events affecting the cruise line, such as mechanical issues or outbreaks of illness onboard.

Comparison of Cruise-Related Insurance Coverage

The level of coverage for cruise-related events varies significantly across different insurance plans. Below is a comparison table illustrating this variation. Note that specific coverage details will always depend on the terms and conditions of your chosen policy.

| Event | Basic Plan Coverage | Comprehensive Plan Coverage | Premium Plan Coverage |

|---|---|---|---|

| Medical Emergency (including evacuation) | Limited coverage, high deductible | Extensive coverage, lower deductible | Comprehensive coverage, low deductible, 24/7 medical assistance |

| Trip Cancellation/Interruption | Limited coverage for specified reasons | Broader coverage, including weather events and family emergencies | Comprehensive coverage, including covered reasons plus trip delay |

| Lost/Delayed Luggage | Limited reimbursement for essential items | Higher reimbursement limits | High reimbursement limits, expedited baggage tracing |

| Cruise Line Issues (mechanical failure, illness outbreak) | Usually not covered | Partial coverage for certain situations | Comprehensive coverage for most disruptions |

Exclusions and Limitations

While travel insurance for cruises offers valuable protection, it’s crucial to understand its limitations. Policies typically exclude certain events or circumstances, and the specific exclusions can vary significantly between providers and policy types. Carefully reviewing the policy document before purchasing is essential to avoid unexpected financial burdens.It’s important to remember that travel insurance is designed to cover unforeseen and unavoidable circumstances.

Events that are foreseeable or preventable are generally not covered. This principle applies across various aspects of cruise travel.

Common Exclusions in Cruise Travel Insurance

Many common exclusions relate to pre-existing medical conditions, adventurous activities, and events that could have been reasonably anticipated. For example, most policies will not cover medical expenses related to a condition you knew about before purchasing the insurance. Similarly, participation in high-risk activities, such as scuba diving without proper certification, might not be covered. Finally, cancellations due to foreseen events, such as inclement weather predicted well in advance of your trip, are often excluded.

Examples of Uncovered Situations

Several scenarios highlight the importance of understanding exclusions. Suppose you cancel your cruise because you simply changed your mind. This is generally not covered. Similarly, if you fail to obtain necessary travel documents, such as a passport or visa, leading to a missed cruise, the insurance likely won’t cover the costs. If you fall ill due to a pre-existing condition that you knew about prior to your trip, your medical expenses might not be reimbursed.

Finally, damage to personal belongings due to negligence, such as leaving valuables unattended, usually isn’t covered.

The Importance of Reading the Policy’s Fine Print

Before purchasing any travel insurance policy, thoroughly read the terms and conditions, paying close attention to the exclusions. Look for specific details on what is and isn’t covered regarding medical emergencies, trip cancellations, lost luggage, and other potential issues. Don’t hesitate to contact the insurance provider directly if you have any questions or need clarification on specific aspects of the policy.

Understanding the fine print ensures you’re protected in the event of unexpected circumstances, but also avoids false expectations about what the insurance will and will not cover. This proactive approach helps prevent disappointment and potential financial hardship during your cruise vacation.

Choosing the Right Cruise Travel Insurance

Selecting the appropriate travel insurance for your cruise vacation is crucial for peace of mind. The right policy can protect you from unexpected events, minimizing financial losses and ensuring a smoother travel experience. Consider your trip’s specifics and personal risk tolerance when making your choice. Failing to do so could leave you vulnerable to significant unforeseen expenses.Choosing a suitable cruise travel insurance plan requires careful consideration of several key factors.

Understanding your needs and comparing different providers will help you secure the best coverage at a reasonable price. Remember, the cheapest option isn’t always the best if it lacks essential coverage for potential cruise-specific issues.

Factors to Consider When Selecting Cruise Travel Insurance

Before purchasing, carefully assess your needs. Consider the length of your cruise, your destination, the value of your trip, and your personal health conditions. A comprehensive checklist can simplify this process.

- Trip Cost: Ensure the policy’s coverage limit exceeds your total trip expenses, including flights, cruise fare, excursions, and pre-paid activities.

- Destination and Activities: Some policies offer better coverage for specific regions or activities. If you plan on adventurous excursions, confirm the policy includes coverage for those activities.

- Pre-existing Medical Conditions: Disclose any pre-existing medical conditions honestly. Some policies may exclude coverage for conditions not declared beforehand, or may require additional premiums.

- Emergency Medical Evacuation: This is especially crucial for cruises to remote locations. Confirm the policy covers medical evacuation by air or sea, a potentially very expensive undertaking.

- Trip Interruption or Cancellation: Check the reasons for coverage and the reimbursement limits. Consider the potential impact of flight cancellations, severe weather, or family emergencies.

- Baggage Loss or Delay: Ensure the policy covers the replacement or recovery of lost or delayed luggage, including the cost of essential items during a delay.

- Customer Reviews and Ratings: Research different providers and read customer reviews to assess their claim processing speed and customer service responsiveness.

Comparison of Pricing and Coverage Among Providers

Insurance providers offer various plans with different price points and coverage levels. Direct comparison is key. For example, one provider might offer a comprehensive plan with a higher premium, while another might offer a basic plan at a lower cost but with limited coverage.

| Provider | Plan Name | Price (Example) | Coverage Highlights |

|---|---|---|---|

| Travel Guard | Cruise Traveler | $150 (example) | Comprehensive medical, trip cancellation, baggage loss |

| Allianz Global Assistance | Cruise Travel Insurance | $120 (example) | Medical, trip interruption, emergency assistance |

| World Nomads | Explorer | $100 (example) | Good for adventure activities, medical, trip cancellation |

*Note: Prices are examples only and vary based on trip length, destination, and individual circumstances.*

Key Features of Popular Travel Insurance Plans

Several popular travel insurance providers offer specific plans tailored for cruise vacations. Understanding their key features can help in your selection.

- Travel Guard: Often includes comprehensive medical coverage, trip cancellation and interruption coverage, and baggage loss protection. They frequently offer robust 24/7 assistance services.

- Allianz Global Assistance: Known for their wide range of plans and options, allowing for customization based on individual needs. They also provide a good level of emergency assistance services.

- World Nomads: Popular with adventurous travelers, often offering broader coverage for activities like scuba diving or hiking. Their plans usually include medical evacuation coverage.

Filing a Claim

Filing a travel insurance claim after a cruise-related incident requires prompt action and careful documentation. The process generally involves notifying your insurer as soon as reasonably possible after the incident occurs, gathering all necessary supporting documentation, and completing the claim form accurately and thoroughly. Failure to adhere to these steps may delay or even prevent the successful processing of your claim.The specific steps involved in filing a claim may vary slightly depending on your insurance provider, but the overall process remains consistent.

Generally, you’ll need to contact your insurer’s claims department via phone or online portal, providing them with preliminary details of the incident. They will then guide you through the next steps, which usually include submitting a completed claim form and supporting documentation.

Necessary Documentation for a Successful Claim

Providing comprehensive documentation is crucial for a smooth and efficient claims process. This ensures the insurer can accurately assess your claim and determine the appropriate compensation. Insufficient or missing documentation can significantly delay the process or lead to claim rejection.

- Completed Claim Form: This form, provided by your insurer, requests detailed information about the incident, including dates, times, locations, and involved parties.

- Proof of Purchase: This includes your travel insurance policy documents and proof of payment.

- Medical Records: If the incident involved medical treatment, detailed medical records, including doctor’s reports, hospital bills, and prescriptions, are essential. These should clearly Artikel the diagnosis, treatment received, and any ongoing medical needs.

- Police Report (if applicable): If the incident involved theft, loss, or injury resulting from a crime, a copy of the police report is crucial.

- Photographs or Videos (if applicable): Visual evidence of damaged belongings, injury sites, or the scene of the incident can significantly strengthen your claim.

- Airline/Cruise Line Documentation: This includes flight or cruise itineraries, boarding passes, and any relevant communication with the cruise line regarding the incident.

- Receipts and Invoices: For expenses incurred due to the incident (e.g., medical bills, replacement of lost belongings), original receipts and invoices are necessary to substantiate the claim amount.

Typical Claim Processing Timeframe

The time it takes to process a travel insurance claim can vary depending on the complexity of the claim, the amount of documentation required, and the insurer’s workload. While some simple claims may be processed within a few weeks, more complex claims involving significant medical expenses or legal issues may take several months. It’s essential to be patient and proactive in following up with your insurer to track the progress of your claim.

For example, a simple claim for lost luggage might be processed within 2-4 weeks, while a claim involving a serious medical emergency requiring extensive treatment could take 8-12 weeks or longer. Always refer to your policy’s specific guidelines regarding claim processing times.

Related Travel Information

Planning a cruise vacation involves more than just booking a ticket. Understanding popular destinations, finding the best deals, and utilizing helpful resources can significantly enhance your overall experience. This section provides valuable information to assist in your cruise planning process, from choosing a destination to packing your bags.

Popular Cruise Destinations

Cruise lines offer itineraries to a vast array of destinations worldwide. The Caribbean remains a consistently popular choice, offering stunning beaches, vibrant cultures, and diverse excursions. The Mediterranean offers a rich history, delicious cuisine, and picturesque islands to explore. Alaska cruises provide breathtaking scenery, wildlife viewing opportunities, and glacier exploration. For those seeking a more exotic experience, cruises to the Mexican Riviera, South America, or the Far East are increasingly popular, each providing unique cultural and scenic experiences.

Ultimately, the ideal destination depends on personal preferences and desired experiences.

Finding Travel Deals and Discounts

Securing cost-effective cruise vacations requires proactive planning and research. Websites specializing in cruise deals often offer significant discounts, particularly during shoulder seasons or for last-minute bookings. Consider joining cruise line loyalty programs to earn points and discounts on future voyages. Utilizing travel agents can also be beneficial, as they often have access to exclusive deals and can help navigate the booking process.

Travel during the off-season, which varies depending on the region, can lead to substantial savings on both cruise fares and related travel expenses. Flexibility in travel dates can also increase your chances of finding a better deal.

Useful Travel Apps for Cruise Planning

Several mobile applications can streamline the cruise planning process. Cruise planner apps allow you to organize itineraries, manage bookings, and access real-time information about your cruise. Navigation apps provide offline maps and directions, crucial for exploring destinations during shore excursions. Currency conversion apps simplify budgeting and transactions in foreign countries. Packing list apps help ensure you don’t forget essential items.

Finally, translation apps can facilitate communication in areas where English isn’t widely spoken. Examples include apps such as Cruise Compass, PackPoint, and Google Translate.

Benefits of Travel Blogs and Guides

Travel blogs and guides provide invaluable insights into cruise destinations and itineraries. They often offer firsthand accounts of experiences, practical tips, and recommendations for activities and excursions. Reading reviews and comparing experiences from different sources can help you make informed decisions about your itinerary and shore excursions. Many blogs offer detailed information on specific cruise lines, ships, and itineraries, helping you to choose the best option for your needs and budget.

This research can save you time and potentially prevent unexpected issues during your trip.

Essential Items to Pack for a Cruise Vacation

Packing efficiently for a cruise requires careful planning. Essential items include comfortable walking shoes, swimwear, sunscreen, insect repellent, hats, sunglasses, and appropriate clothing for both warm and cool weather. Remember to bring any necessary medications, travel documents (passport, visa, cruise tickets), and personal toiletries. A reusable water bottle can help you stay hydrated, and a small backpack is useful for carrying essentials during shore excursions.

Don’t forget a power adapter if traveling internationally. A versatile outfit for formal nights is also crucial, depending on the cruise line’s dress code.

Helpful Travel Gadgets for Enhancing a Cruise Experience

Several travel gadgets can significantly enhance your cruise experience. A portable charger keeps your electronic devices powered up throughout the day. An underwater camera captures memorable moments during water activities. Noise-canceling headphones provide peace and quiet in bustling environments. A universal adapter ensures your electronic devices can be charged anywhere.

A travel-sized steamer keeps clothes wrinkle-free, maintaining a polished appearance. These additions ensure a more comfortable and enjoyable trip.

Planning a Cruise Vacation: A Guide

Planning a cruise vacation involves several key steps. First, establish a budget, considering cruise fares, port taxes, gratuities, shore excursions, and onboard spending. Next, research and select a cruise line and itinerary that aligns with your preferences and budget. Once booked, create a detailed itinerary, including planned excursions and onboard activities. Finally, make necessary pre-trip preparations such as arranging transportation to and from the port, obtaining travel insurance, and packing your bags.

Careful planning ensures a smooth and enjoyable cruise experience.

Cruising should be a carefree adventure, and securing the right travel insurance is a key step in ensuring it remains so. By carefully considering the coverage offered, understanding the exclusions, and choosing a plan that aligns with your trip’s specifics and personal risk tolerance, you can navigate the unexpected with confidence. Remember to always read the fine print and don’t hesitate to contact your insurer with any questions before, during, or after your cruise.

Helpful Answers

What happens if my cruise is cancelled due to a hurricane?

Coverage depends on your policy. Many comprehensive plans cover cancellations due to unforeseen circumstances like hurricanes, but check your policy’s specific wording regarding weather-related events.

Does travel insurance cover pre-existing medical conditions?

Some policies offer coverage for pre-existing conditions, but this usually requires purchasing the insurance well in advance of your trip and disclosing the condition during the application process. Coverage may also be limited.

What if I need medical attention onboard the ship?

Most cruise travel insurance policies cover emergency medical expenses incurred during your cruise, including doctor visits and hospital stays. However, there might be limits on the amount covered.

Can I claim for lost or stolen belongings?

Yes, many policies cover loss or theft of personal belongings, but you’ll likely need to provide proof of ownership and file a police report. Coverage limits apply.